No products in the cart.

Josh Aharonoff – Financial Modeling Fundamentals

$200.00 $35.00

- Payment method: I will send the payment link to your email.

- Deliver by: Google Drive, Mega.nz

Category: Others

Proof of payment:

Master Financial Modeling with Josh Aharonoff – Unlock Your Career Potential

Josh Aharonoff, widely recognized as “The CFO Guy,” is a seasoned finance expert whose innovative approaches to financial modeling have transformed countless careers. With a background in Big 4 accounting and as the founder of Mighty Digits, Josh Aharonoff brings real-world expertise to his Financial Modeling Fundamentals course, helping professionals bridge the gap between theoretical knowledge and practical application. This article explores how his teachings, including free financial modelling training elements, empower individuals to master essential tools and advance in their finance roles.

Table of Contents

Introduction to Financial Modeling Fundamentals

Financial modeling has become an indispensable tool in the modern finance landscape, serving as the backbone for strategic decision-making in companies of all sizes. Professionals who can adeptly navigate complex financial models are no longer just support staff; they are pivotal advisors who influence everything from budgeting to investor relations. The rise of data-driven businesses has amplified the need for accurate, dynamic models that integrate profit and loss statements, balance sheets, and cash flow analyses. However, many finance and accounting experts find themselves stuck in a rut, armed with theoretical knowledge from textbooks or basic courses but lacking the hands-on skills to apply it effectively. Josh Aharonoff, through his Financial Modeling Fundamentals course, addresses this critical gap by emphasizing the mastery of three-statement models—those that link income statements, balance sheets, and cash flows seamlessly. This not only enhances strategic influence but also propels career advancement, turning everyday number-crunchers into trusted partners for executive leadership. By focusing on practical implementation, Josh Aharonoff‘s program underscores the value of these skills in a competitive job market, where financial modeling foundations: essential tools for financial professionals can be the key to unlocking promotions and high-impact roles.

The importance of financial modeling extends beyond mere technical proficiency; it’s about storytelling with numbers to drive business growth. In an era where executives demand quick, insightful analyses, professionals equipped with robust modeling skills can provide forecasts that predict outcomes and mitigate risks. Financial Modeling Fundamentals, led by Josh Aharonoff, introduces learners to the foundational concepts that differentiate high-performers from the rest, such as building models that adapt to real-time changes and communicate complex ideas simply. This course isn’t just about learning Excel formulas; it’s a comprehensive pathway that combines free financial modelling training resources with advanced strategies, ensuring participants emerge with the confidence to influence boardroom discussions. As businesses increasingly rely on accurate financial projections, mastering these fundamentals becomes a career differentiator, positioning individuals as strategic assets rather than operational cogs.

The Core Challenges Faced by Finance and Accounting Professionals

One of the most pervasive issues in the finance world is career stagnation, where talented individuals remain overlooked due to a lack of advanced modeling expertise. Many professionals, despite their strong analytical backgrounds, struggle to transition into coveted roles like Financial Planning & Analysis (FP&A), as employers prioritize candidates who can build and interpret comprehensive financial models. This frustration often stems from overwhelming uncertainty when constructing three-statement models in Excel, leaving workers questioning if they’re adhering to best practices or inadvertently creating errors that undermine their credibility. Josh Aharonoff highlights in his materials that this skills gap not only halts professional growth but also fosters a sense of inadequacy, turning potentially dynamic careers into repetitive routines. The disconnect is further exacerbated by ineffective models that fail to resonate with stakeholders, emphasizing the need for financial modeling foundations: essential tools for financial professionals to bridge this divide.

Communication breakdowns add another layer of difficulty, as finance experts often find their meticulously crafted models met with confusion or disinterest from non-finance colleagues. This arises from a common pitfall: models that are technically sound but lack a clear narrative, resulting in “glazed eyes” during presentations and missed opportunities for influence. The theory-to-practice gap is particularly glaring, with many having completed courses that delve into accounting principles without providing the practical framework to implement them. As Josh Aharonoff points out, this leads to a frustrating cycle where knowledge feels theoretical and disconnected, preventing professionals from demonstrating their full value. In essence, these challenges create a barrier to strategic involvement, where insights fail to gain traction, and promotions go to those who can effectively translate numbers into actionable business stories.

The Strategic Solution: Financial Modeling Fundamentals Course

Financial Modeling Fundamentals, an on-demand course crafted by Josh Aharonoff, offers a structured, step-by-step solution to the skills deficit plaguing finance professionals. Unlike scattered online tutorials or overly theoretical programs, this course prioritizes immediate applicability, guiding learners from basic Excel familiarity to constructing professional-grade models that integrate seamlessly. By focusing on real-world scenarios drawn from Josh Aharonoff‘s extensive experience, the program bridges the gap between novice spreadsheet use and expert-level analysis, empowering users to create models that support strategic decisions. This approach transforms participants from mere data handlers into influential advisors, equipped with the tools to forecast, analyze, and present financial data with precision and confidence.

At its core, the course emphasizes practical skills over abstract concepts, making it an efficient alternative to traditional learning methods. Josh Aharonoff, known for his no-nonsense style, structures the content to address common pain points, such as building connected financial statements that reflect business realities. Participants learn to develop models that are not only accurate but also adaptable, allowing for dynamic updates that flow through the entire system. This strategic solution is particularly appealing for those in free financial modelling training phases, as it includes accessible resources that accelerate learning without overwhelming beginners. Ultimately, Financial Modeling Fundamentals positions users as strategic partners, ready to engage in high-level discussions and drive organizational success.

Key Promises and Outcomes of the Course

A primary promise of Financial Modeling Fundamentals is the ability to construct fully integrated three-statement models, where changes in one area automatically ripple through to others, providing a holistic view of financial health. Led by Josh Aharonoff, the course ensures learners master this interconnectedness, moving beyond isolated calculations to create models that are robust and insightful. This skill transformation not only boosts efficiency but also enhances the user’s role in strategic planning, allowing them to generate projections that inform key decisions. Graduates often report a newfound ability to influence executives, turning what was once a peripheral function into a central one, all while leveraging financial modeling foundations: essential tools for financial professionals for career elevation.

Beyond technical prowess, the course delivers enhanced storytelling capabilities, teaching participants how to present financial insights in a way that captivates non-finance audiences. Josh Aharonoff‘s emphasis on clear communication means learners leave with the confidence to defend their models under scrutiny, fostering interactions with top leadership like CEOs and boards. This outcome is transformative, as it shifts professionals from reactive reporters to proactive influencers, directly impacting business strategies. By focusing on outcomes like increased confidence and executive engagement, the course promises a pathway to measurable career advancement.

Unique Advantages of the Approach

What sets Financial Modeling Fundamentals apart is its comprehensive coverage of financial statement interconnections, going beyond mere formulas to explore how elements like revenue drivers affect the entire model. Josh Aharonoff draws from his real-world experiences to teach these connections in a way that’s intuitive and practical, ensuring learners understand the “big picture” rather than isolated tricks. This holistic method not only builds stronger models but also equips users to handle complex scenarios, making free financial modelling training aspects even more valuable for beginners. The result is a skill set that stands up to real business challenges, turning abstract knowledge into actionable expertise.

Efficiency is another key advantage, with Josh Aharonoff‘s shortcuts slashing modeling time from weeks to days, without compromising quality. By incorporating real-world scenarios from startups and larger firms, the course emphasizes confidence-building through deep explanations of the “why” behind each technique. This approach ensures users can adapt models to various contexts, promoting clarity and professionalism. Overall, it focuses on creating user-friendly models that anyone can understand, solidifying financial modeling foundations: essential tools for financial professionals as a game-changer.

Course Curriculum: Modules and Learning Objectives

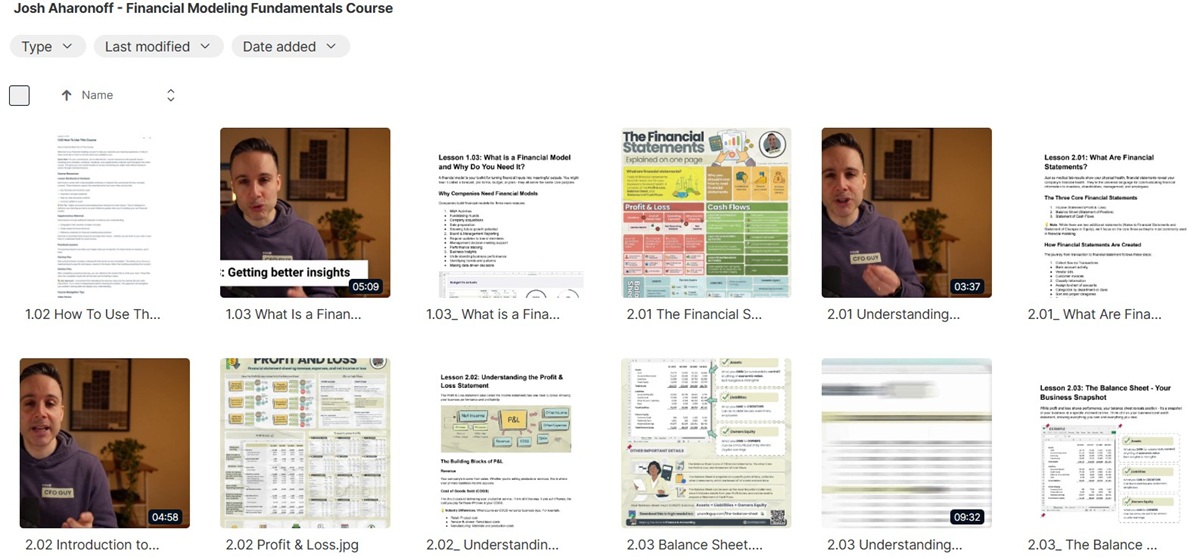

The Financial Modeling Fundamentals curriculum, designed by Josh Aharonoff, is meticulously structured into 12 modules that guide learners from basic concepts to advanced mastery. In Module 01, the course introduction sets the stage by outlining the structure and highlighting how financial modeling drives career growth, encouraging participants to see it as a strategic tool. Module 02 dives into Financial Statements 101, where students master the P&L, balance sheet, and cash flow statements, learning their interconnections and the nuances of cash versus accrual accounting. As the modules progress, Module 03 focuses on building professional P&L and balance sheet templates from scratch, incorporating industry-best-practice formatting for clarity and accuracy.

Building on these foundations, later modules address more complex elements, such as Module 04’s detailed construction of the cash flow statement using the indirect method, ensuring it balances correctly for reliable analysis. Subsequent modules cover integrating these statements into a cohesive model, implementing best practices for organization and version control, and adding features like error checks and dashboards. By Module 10, learners tackle variance analysis and rolling forecasts, applying all principles to real-world scenarios. Josh Aharonoff ensures each module includes practical exercises, making free financial modelling training components accessible and reinforcing financial modeling foundations: essential tools for financial professionals throughout.

Teaching Methodologies and Practical Techniques

Josh Aharonoff employs innovative teaching methodologies in Financial Modeling Fundamentals, such as the “Drivers Tab” for centralizing assumptions, which enhances model credibility and simplifies updates. This technique allows users to manage variables efficiently, ensuring that changes propagate accurately across statements. Another practical tool is the color-coding system for input versus formula cells, which prevents common errors and promotes transparency, making models easier to audit. By integrating these methods, the course transforms theoretical learning into hands-on proficiency, with automated error detection features that safeguard against inaccuracies.

Participants also learn techniques for financial storytelling, like designing effective Budget vs. Actual dashboards for proactive management. Josh Aharonoff‘s use of Excel’s “Name Manager” to maintain data integrity exemplifies how these methodologies streamline processes, enabling users to present insights that engage executives. This focus on practical application ensures that learners not only build models but also communicate their implications effectively, embodying the essence of financial modeling foundations: essential tools for financial professionals.

Instructor Profile: Josh Aharonoff, “The CFO Guy”

Josh Aharonoff, the mastermind behind Financial Modeling Fundamentals, boasts a distinguished career that began in Big 4 accounting firms, where he honed his expertise in financial reporting. As the founder of Mighty Digits, he has assisted startups and mid-sized companies in raising venture capital, leveraging his skills to create dashboards that drive growth. His journey from corporate finance to entrepreneurship underscores his ability to translate complex concepts into actionable strategies. Today, with over 400,000 LinkedIn followers and 100,000 newsletter subscribers, Josh Aharonoff has become a go-to authority for Excel mastery and financial modeling.

What makes Josh Aharonoff truly exceptional is his commitment to education, developing templates and plug-ins that simplify financial tasks for professionals worldwide. His specialty in creating efficient tools has helped thousands elevate their careers, making free financial modelling training a staple in his offerings. Through his engaging style, he demystifies advanced topics, positioning himself as a relatable expert who bridges the gap between theory and practice.

Product Offerings and Value Proposition

Financial Modeling Fundamentals is offered at an accessible $200, providing full access to course content, guides, templates, and lifetime updates, making it a cost-effective alternative to pricier options. For those seeking more, the Premium Membership through The Board Room at $225 per month includes ongoing access to all courses, live masterminds, and community support, with direct interaction from Josh Aharonoff. This value proposition stands in stark contrast to traditional MBAs, which cost tens of thousands but often lack practical focus.

Compared to disjointed online tutorials, this course offers cohesion and depth, while outperforming trial-and-error methods by delivering proven shortcuts. Josh Aharonoff‘s emphasis on real-world application ensures participants gain financial modeling foundations: essential tools for financial professionals, maximizing their investment.

Target Audience and Risk-Free Guarantee

This course is ideal for beginners with no advanced Excel skills, targeting those transitioning into FP&A or corporate finance across various industries. Its universal principles make it relevant for anyone from startups to established firms, helping overcome career hurdles. Josh Aharonoff designs it to be inclusive, incorporating free financial modelling training elements to ease entry.

The 30-day money-back guarantee, requiring proof of effort like completed lessons and model submissions, underscores the course’s commitment to results, minimizing risk for participants.

Conclusion

In summary, mastering financial modeling fundamentals is essential for advancing in finance roles, as it equips professionals with the practical skills to influence strategic decisions and elevate their careers. The Financial Modeling Fundamentals course, led by expert Josh Aharonoff, offers a practical, efficient, and comprehensive pathway to develop these abilities, transforming users from basic analysts to strategic partners through integrated three-statement models and effective communication techniques. By addressing common challenges like career stagnation and ineffective models, it empowers individuals to tell compelling financial stories, engage with executives, and achieve lasting professional growth, making it an invaluable resource in today’s competitive landscape.

Sales Page: _https://www.yourcfoguy.com/courses/financial-modeling-fundamentals

Be the first to review “Josh Aharonoff – Financial Modeling Fundamentals” Cancel reply

Related products

Sale!

Sale!

Sale!

Sale!

Sale!

Sale!

Sale!

Reviews

There are no reviews yet.